What is a house rent receipt?Ī house rent receipt acts as a documentary record of your rent payment. Unless you provide the rent receipts for income tax to your HR department at the time of investment proof submission, a substantial chunk of your salary might get deducted in taxes. That is when the need to produce house rent receipt or a rent slip arises. However, to claim the deductions, the tenant in question will have to prove a proof of making these payments. Those who spend a substantial part of their annual income in rent payments are also qualified to claim deductions against the annual payment under various sections of the tax law. However, the same law also allows them a variety of deductions against the expenses made towards specific instruments. Those earning an income in India, salaried individuals as well as business professionals, are liable to pay taxes on their annual income under the income tax law.

Receipts generator pdf#

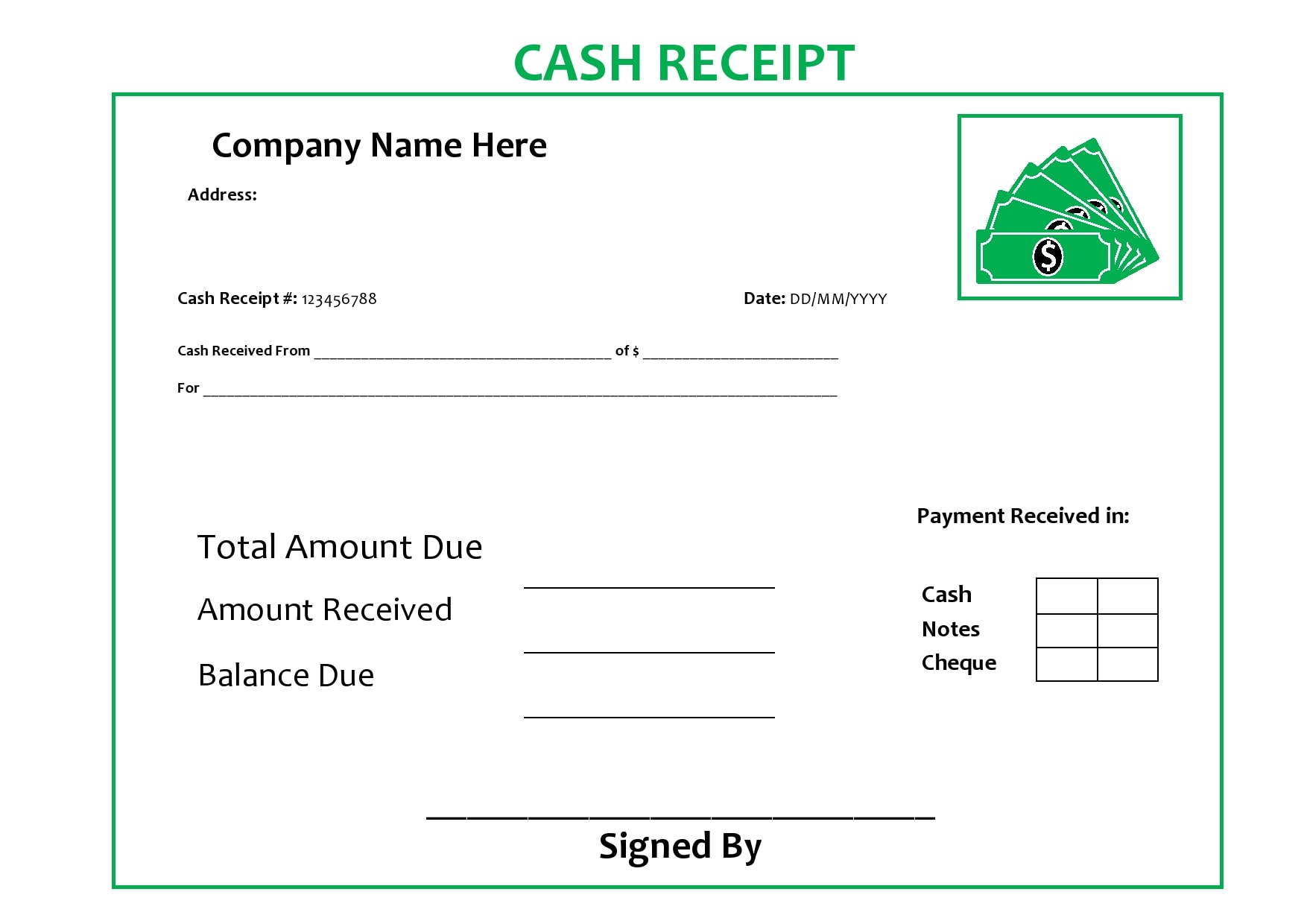

Once you are happy with your receipt, you can click "Download PDF" to receive your PDF file. If you do not wish to include the other details on your receipt you can leave them blank and they will not appear on the exported PDF.

The only required information is your name, your recipients name, and at least one receipt item. VAT exclusive) tax rates, as well as percentage-based and fixed-rate discounts. You can adjust your tax & discount in Settings. We currently support JPG and PNG logo files. To upload your business logo, click the "Upload your logo" box at the top of the receipt and select your image file.

Receipts generator update#

As you enter receipt items, you will see the totals update in realtime at the bottom of the receipt.

Receipts generator free#

You can create your free receipt PDF by typing the details into the form above.

0 kommentar(er)

0 kommentar(er)